World Shares Drop After Trump’s Comments on China Deal and Tariffs

Global shares took a dive after US President Donald Trump’s comments had investors worrying about the state of world trade.

While in London for the NATO summit, the US president announced an increase on tariffs on aluminum and steel from Argentina and Brazil. He also proposed of up to a 100% levy on prized French exports like champagne, cheese, handbags, porcelain, and yoghurt.

The new tariffs were America’s answer to France’s new digital services tax, which Washington says could harm the country’s top tech companies, like Amazon, Facebook, and Google.

Robert Lighthizer, the US Trade Representative, said the proposed tariffs “sends a clear signal” that they will act against digital taxes that targets or places “undue burdens” on American companies.

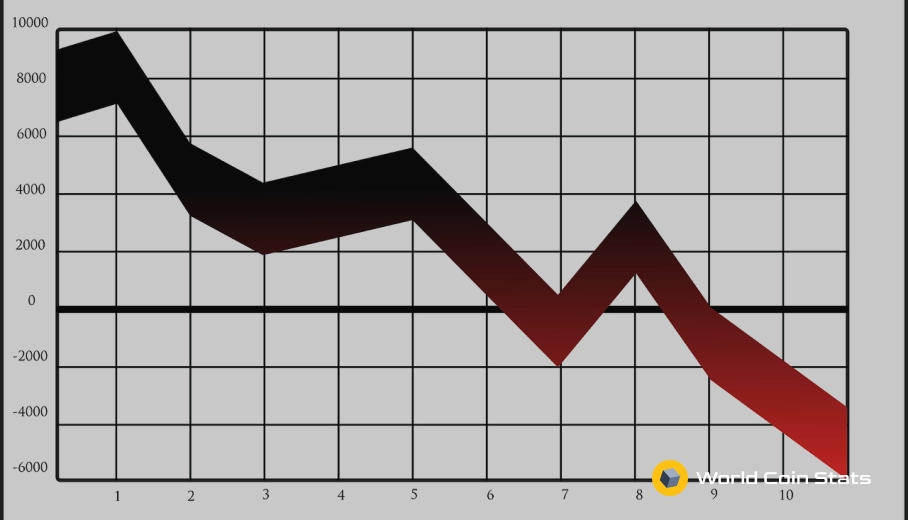

The announcement has alarmed the financial markets and saw stocks around the world tumbling. Wall Street slipped by one percent at the end of the trading day while the European stock market experienced their biggest per day drop in two months.

The Pan-European Stoxx 600 closed the day 1.6% lower, with all major bourses and sectors in the red. The DAX of Germany was 2% down but rebounded a little.

The Asian stock market fell as investors wait for clarification on the US-China trade deal. The two countries are yet to sign a preliminary trade deal before Dec. 15. Otherwise, the US could place a 15% levy on $156 billion worth of products from China.

The Hang Seng ended the day with a 0.2% drop to 26,391.30. It was a slight improvement to the 26,063.02 it hit early on Tuesday. The Nikkei slipped by 0.6% to end at 23,379.81 while the KOSPI retreated by 0.4% to 2,084.07. The S&P/ASX 200 of Australia plummeted 2.2% to 6,712.30. The Shanghai Composite enjoyed a slight gain of 0.3% to 2,884.70.

However, Trump’s recent comments about having no deadline on the China trade deal and his hints that it might be better to wait after the 2020 elections is expected to have deeper repercussions. Investors were already wary about a new agreement pushing through. But Trump’s latest revelations could dash their hopes.

Meanwhile, the US president’s planned tariffs on French products will be met with a “strong European riposte.”

Bruno Le Maire, France’s Finance Minister, called the levies “unacceptable” and not the behavior the country was expecting from one of its supposed allies. He said they already talked with the European Commission about retaliatory moves if the US does impose tariffs next month.