What is the Fear and Greed Index?

Experienced investors have witnessed the markets’ extreme fear and greed in recent years. Psychological factors, such as fear, greed, and other emotional responses to price fluctuations and dramatic changes, can lead to devastating results. Moreover, according to scientists, there is a direct link between emotional reactivity and trading performance. But what exactly is fear and greed index?

Emotions are Important

According to a case study, significant emotional responses are counterproductive from the perspective of trading performance. In other words, the emotional state of every investor is essential when it comes to trading decisions.

However, these emotions can be influenced by many factors such as market events and news, environmental conditions, information about the tradainstrument’s history as well as the speculative opinions of others. Also, there is a negative correlation between successful trading behavior and emotional reactivity.

What Is the Fear and Greed Index?

So, CNNMoney first developed this index. Apparently, the CNNMoney team knew how important these two emotions are when it comes to investing. As primary emotional factors, fear and greed influence investors’ decisions. How much is the investor willing the pay for the tradable instrument? Is the investor going to invest now or wait for a better moment?

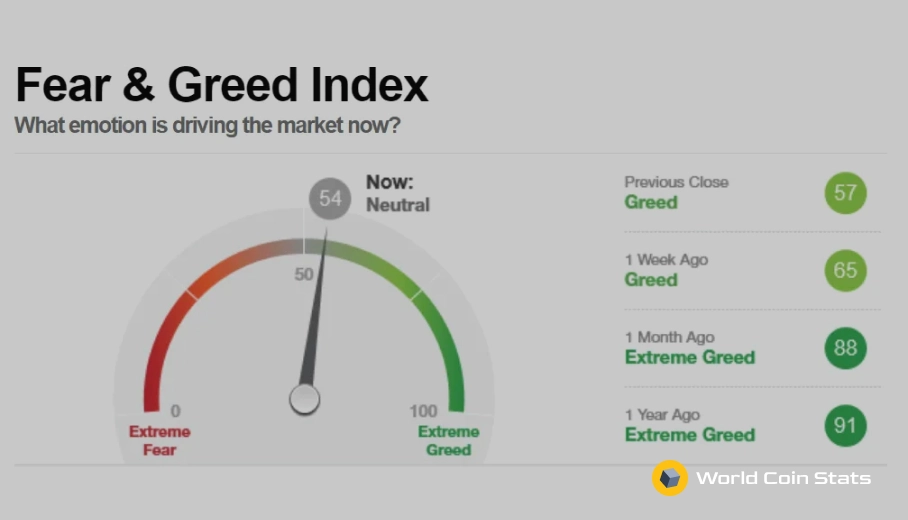

The fear and greed index measures precisely this. Moreover, it measures on a daily, weekly, monthly, and yearly basis. Nowadays, many investors who want to know whether the market price is fair use this index. Also, they assume that excessive fear drives down share prices. On the other hand, too much greed is considered to have the opposite effect.

In other words, excessive fear results in trading instruments below their intrinsic values. Meanwhile, greed leads instruments costing much more than their worth. So, the fear and greed index is a contrarian index of sorts.

Can The Fear and Greed Index Be Beneficial?

The answer to this question is yes. Of course, fear and greed can be viewed negatively. After all, they are strong motives when it comes to humans and money. However, by understanding and learning how the fear and greed index work, one can make a better investment.

Moreover, this index has been a reliable indicator of a turn in equity markets in the past. Further, many experienced investors and market makers agree that this index can come in handy. However, many other investment tools might help investors when making a choice.

Also, when it comes to the fear and greed index, investors are typically advised to keep tabs on fear for potential buying the dips opportunities and view periods of greed as a potential indicator that stocks might be overvalued. Furthermore, some investors see this index as a barometer for the market-timing crowd.

Moreover, CNN uses seven different factors when establishing how much fear and greed there is in the market. If you want to learn which are these seven factors, make sure you read this article.