What are Vanguard Index Funds?

Does investing scare you, yet you want high returns? Do you hold back on investing in the hottest stocks for fear they’ll crash? The Vanguard Index Fund may be the perfect investment, as it offers a passive investing option with returns that mimic the stock market.

Keep reading to learn more.

Understanding Vanguard Index Funds

The Vanguard index fund doesn’t try to beat the market – it tries to mimic it. This was a new concept when John Bogle, the Vanguard founder, introduced the topic. His goal was to make the stock market more accessible for the ‘every day’ investor to invest in.

What’s the difference? For starters, it doesn’t require active investing. When you invest in an index fund, you invest in mutual funds (and sometimes ETFs) with thousands of other investors. Everyone pools their funds to buy shares in a fund that works alongside the index.

What else? Let’s talk about fees. Active investing is expensive. Every time you buy and sell an asset, you pay fees. When you take part in passive investing, there’s less buying and selling, so fewer costs. Rather than buying and selling often, you ride out the storm, eventually getting the returns you desire.

Since Vanguard was a pioneer in the mutual fund industry, it makes sense that thousands flock to the Vanguard Index Funds.

How They Work

The Vanguard Index Fund includes stocks from the entire index, or at least each industry within the index. You invest in the shares you want, whether it’s a particular company or a specific sector. You get a prorated portion of the returns based on your investment.

Vanguard also offers bond market index funds if you want a lower risk (stocks are risky). Since bonds have a lower risk, the returns are more conservative, but the losses are too. Vanguard buys mostly government and corporate bonds for its index funds.

Why is Passive Investing in Vanguard Index Funds Better?

Typically, passive investing outperforms active investing. On average, active investors beat the market 10% of the time. That’s a lot of risk for minimal returns.

Passively investing in Vanguard’s Index Funds does a few things. First, it diversifies your funds over a series of investments. Rather than focusing on one company’s shares and hoping it provides a high return, you invest in many companies and/or industries, which diversifies your risk.

Does this mean the Vanguard Index Fund will always come out ahead? Unfortunately, no, it won’t. There are times it will drop like it did every year from 2018. But, if you look at the big picture, say the 10-year return, you’ll see a much higher annual return than you’d find with any other active investment.

Why Consider Vanguard Index Funds?

Diversifying is the key to high returns, but why Vanguard Index Funds? Here are a few reasons:

- Vanguard’s average ETF expense ratio is lower than more than ¾ of the industry

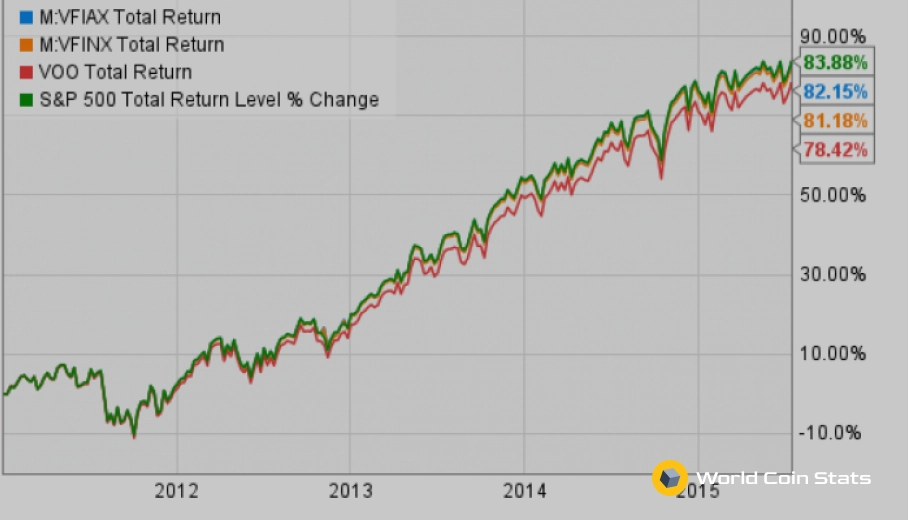

- Almost 85% of Vanguard’s index funds outperformed competing investments in the last 10 years

- Vanguard is one of the oldest index funds available, and it keeps getting better with age

How Much do you Need to Invest?

You may invest in the Vanguard Index Fund in a few ways. Through your 401K is the most popular option. You get a variety of choices and need a minimum of $3,000 to invest, typically with a selection of 38 different index funds.

If you want to invest through a broker or buy directly from Vanguard, you’ll need a minimum of $3,000 and sometimes up to $100,000. Vanguard offers what they call Admiral Shares, which requires the most substantial investment, but the highest returns along with low expense ratios.

If you don’t have $3,000 to invest, there’s another option – Vanguard ETFs. These have no minimum investment required and can be traded at any time. If you prefer a more active method of investing, but don’t want to invest in stocks, Vanguard ETFs are a great option.

Popular Vanguard Index Funds

While Vanguard has too many index funds to list, a couple of the most popular include:

- Vanguard 500 – Similar to the S&P 500, this fund gives you access to 500 of the hottest stocks in the market. With an expense ratio of just 0.04%, it’s a great way to invest in some large companies.

- Vanguard Total Bond Market – Invest in a combination of government and corporate bonds (a majority are government bonds) with an expense ratio of 0.15%.

- Vanguard Balanced Index Fund – Who doesn’t love a balanced index, right? Invest in both stocks and bonds with a slightly heavier percentage in stocks to get a diversified portfolio with high returns.

The Vanguard Index Fund is a great way to take part in passive investing while maximizing your returns. With just $3,000, you can jump on the investing bandwagon, taking advantage of some high returns from some of today’s most significant companies.