U.S.-China Trade Causes a Hurdle to Stocks

WASHINGTON, D.C. – Due to the unending hurdle between the world’s two largest economies, the global stocks dropped and caused the investors to head towards their safe haven.

Last Wednesday, the U.S. House of Representatives have submitted two bills – one that expresses their support of the anti-government rallies happening right now in Hong Kong, and the other one is to send a warning to China concerning their violation to human rights.

U.S. President Donald Trump is expected to sign the two bills. Jim Reid, a strategist from the Deutsche Bank, says that the president signing these bills can pose a risk towards the upcoming progress of the U.S.-China trade war deal.

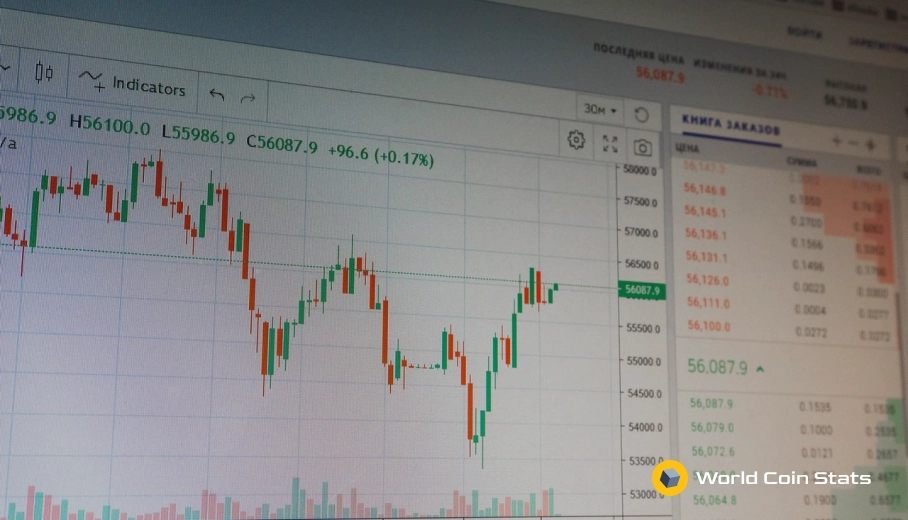

Losses of the European shares have extended from Wednesday with 600 STOXX pan-European. The trade-sensitive Germany’s DAX 30 has dropped 0.7 percent on Thursday.

Outside Japan, the US S&P500 futures have dropped to 0.2 percent, and also a drop of up to 0.6 percent in the Asian Trade. It all happened just one day after the fall of the three primary indexes. As a result, the S&P 500 has lost 0.4 percent.

Ian Williams, the economics and strategy researcher from the Peel Hunt, said that there had been an increase of the cracks in the equity market sentiment.

The S&P 500 managed to hit their highest record last Tuesday on trade deals; however, due to Washington’s move, the protests in Hong Kong were disrupted.

Comments from the people in the White House and the substantial personnel from trading said that the first phase of the U.S.-China trade deal could continue the following year. This is due to Beijing trying to press for more tariff rollbacks. The administration of Trump is now countering China with their own demands.

According to the Bloomberg report, Liu He, the Chinese Vice Premier, and the chief trade negotiator says that he is expectant on the first phase of the deal.

The chances of the deal closing in the shortest time possible are now fading. This has caused a stir in the investors, and they have started to seek the security of their government bonds.

There has been an increase of 0.2 percent spot gold of $US1473.56 per ounce.

The chief strategist of the State Street Global Market, Marija Veitmane, said that their strategy is anchored towards cautiousness, as the trade deal is now driving the market. Every positive report drives the market upward while every negative report pulls it down.