The 5 Best Investment Apps That Can Help You Make Money in 2019

Nowadays, forex trading is a popular way to make money, and what better way to invest than to be able to do it from your mobile phone? With the rise of Forex traders, there has been a rise in the number of investment and stock trading apps too.

But how can one choose the best investment app when there are so many apps to choose from? We have conducted a list of the five best investment apps that can help you make better investment decisions.

So, let’s take a look at the five best investment apps that can help you make and save money in 2019.

Stash

Stash is the best mobile app for beginners who want to learn more about investing and how to find and select the right investment.

This investment app offers educational content and support and aims to make the process of selecting investments easy.

Also, Stash has no minimum balance requirement. It aims to help new investors build an ETF portfolio and teaches them how to manage it.

Advantages of Stash

- Low account minimum of $5

- Educational resources and support

- Goals, Interests and Values-based investment offerings

Disadvantages of Stash

- High fee on small account balances ($1 – $2 / month)

- No management

- High ETF expense ratios (average 0.30%)

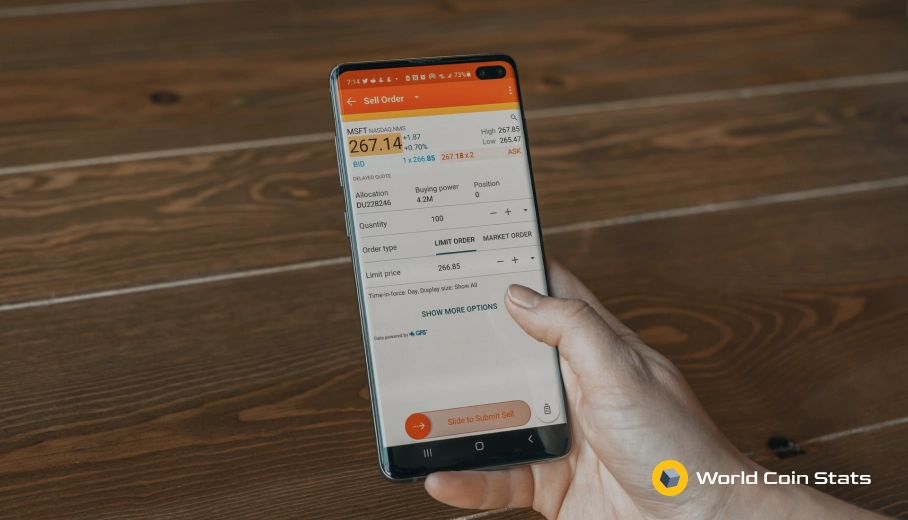

TD Ameritrade Mobile

TD Ameritrade Mobile is one of the largest brokerage firms and offers multiple mobile apps depending on the investors’ needs.

This app is suitable for beginners, advanced traders, as well as investors who seek advice or education. TD Ameritrade Mobile App offers excellent portfolio-building guidance, investment courses, trading tools, and more.

As this app requires a $0 minimum, it makes it easy for new investors to start investing, and that why it ranks second in our charts.

Advantages of TD Ameritrade Mobile

- Great investment selection options

- Portfolio guide

- Investment courses

- Free research and tools

- Multiple high-quality trading platforms

- $0 account minimum

- Great customer support

Disadvantages of TD Ameritrade Mobile

- Higher trade commission

- Costly broker-assisted trades

- High short-term ETF trading fee

Acorns

Acorns Investment app helps its users invest, save, and spend their money responsibly. By pre-ordering a debit card from Acorns, this app lets you set aside spare change from everyday purchases and save it for later.

Acorns app gives its users access to useful articles and videos from financial experts and helps them learn how to get more from their money.

Also, there is no minimum account balance requirement or overdraft fees. Acorns app services cost between $1 and $3 per month.

Advantages of Acorns

- Free management for college students

- Automatically invests spare change

- Cash-back rewards program

- Educational content available

- $0 account minimum

Disadvantages of Acorns

- Small investment portfolio

- High fee on small accounts

TradeStation

TradeStation is best for advanced, active traders. With TradeStation, traders have access to stock, options, and futures.

It also offers a desktop platform that’s especially impressive as it provides direct-market access, and traders can monitor their strategies. As they have a large amount of historical database, traders can back-test their trading ideas.

TradeStation is free for brokerage accounts on other equities or futures commission plans if the account meets minimum activity.

Advantages of TradeStation

- Advanced high-quality trading platforms

- Comprehensive research

- Low commissions

- Easy-to-use advanced tools

- Active trader community

- Back-testing of trading ideas

Disadvantages of TradeStation

- No commission-free ETFs

- Minimum balance requirement of $500

Robinhood

Robinhood is a free, no account minimum app that lets users invest in stocks, ETFs, options, and cryptocurrencies with no fee and no commissions.

This app helps beginners have a clear picture of their portfolio’s performance over time. This way, they can adjust their positions and change their strategy.

Users of Robinhood can access professional research reports, trade on margin, make more significant deposits as well as access tools and features such as price movement notifications and customized investment news.

Advantages of Robinhood

- No commissions on stock trades

- No account minimum

- Streamlined interface

Disadvantages of Robinhood

- No retirement accounts

- No mutual funds or bonds

- Limited customer support

- No trading for bonds or mutual funds

The Bottom Line

With the mentioned above apps, traders can invest in stocks, ETFs, options, futures, and cryptocurrencies right from their phones or computers.

The investment apps aim to help investors find the right moment to invest and make money. This way, both beginners and active traders can take control of their financial future.