Investing in Target (TGT) Stocks: Pros and Cons

With an impressive market cap of $50 billion, Target (TGT) is the second-largest retailer in the US merchandise after Wal-Mart (WMT).

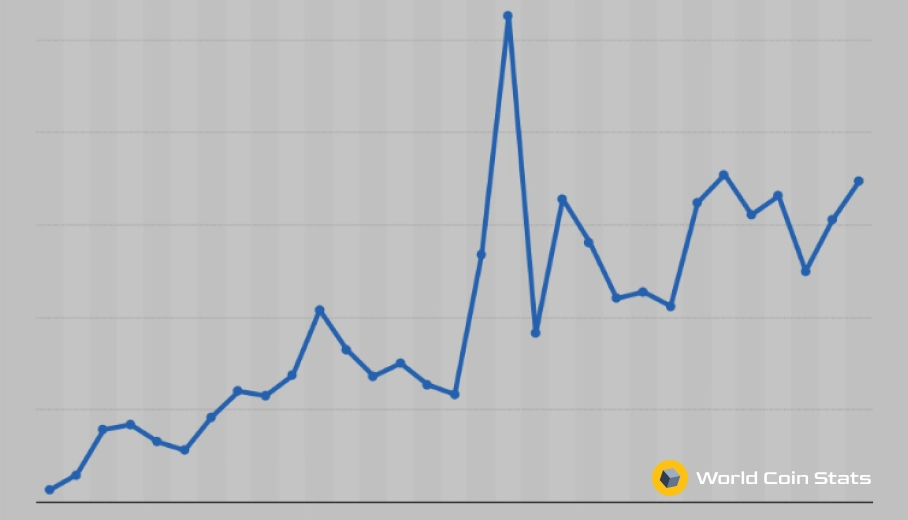

This company has written a remarkable history in the past few years. Target also has a solid track record for investors. With the considerable rise in annual dividends for almost four decades, the investors at present can rely on income and growth as well.

What is Target Known For?

This Minneapolis based popular and big-box retailer is currently serving the market with more than 1828 stores within the United States. Market stats reveal that Target is actively competing with Best Buy, Walmart, Kohl’s Corp, Macy’s, and the big giant Amazon.

Unfortunately, a series of setbacks have recently disturbed the market value of TGT. Now investors need to give significant thought to whether they should invest in it or not.

Setbacks In The Past vs. New Strategies and Ideas

The significant challenges occurred in terms of public relations and stagnated sales. This happened due to the massive data breach of 41 million customer account exposure in the year 2013. In the previous year, TGT paid a colossal fine of $18.5 million to the US courts for the large-scale data breach.

Even after all these disturbing stats, the physical stores of TGT are performing well in the market. The brand is also expecting some growth in the competitive market. The Target Stocks were observed at $70 per share level in the middle of March, whereas the estimated annual Target price went up to $76 for the share.

The company is presently counting on big corporate reinvestment campaign so that it can raise its financial fortunes. A few months back, Target also announced that the company is planning to invest $7 billion on various operations. At the same time, they revealed they are planning to double the cost for small-format stores, as well as driving the grocery prices lower. All this to give more competition to Walmart and Kroger.

With the positive initiatives in the market, Target has now invested $1 billion on its digital retail platform by adding free and faster delivery options. Recently, they also added a new feature to the online platform to compete with Amazon. According to this new addition, they are going to offer guaranteed free delivery for purchases of more than $35. This feature is specific for the customers that own Target REDcard.

Also, the biggest twist in the service comes in terms of delivery service. You might be aware of the fact that Amazon offers delivery through its various fulfillment centers. Well, TGT is offering goods directly from its own store.

Pros of buying Target stock:

- Low Price

This stock in the investment industry is currently available at a low price. TGT

stocks at present at trading with the PE ratio of 15, and it looks excellent when compared to current prices in the market.

With this strategic price setup, TGT is making efforts to beat Amazon and XRT in the market.

- Dividends

TGT follows a strong dividend history that proves its potential in the competitive market. From the last few years, TGT reported positive movements in the industry with substantial earning potential.

Their historical performance attracts new-age investors to make profits from this industry.

- New Strategies and Ideas

They focus on the core business with strong operation ideas. Although the company has suffered several significant problems in recent years, they are still working hard to fix the issues fast.

The management is designing new models to set the market on fire while dealing with both reputational and financial risks.

Cons of buying Target stocks:

- Online Sales

Stats reveal that Target is maintaining a weak position over an online platform. The online sales share only 3% of the overall sales of this brand, and it defines an inferior condition.

With the positive efforts in the online sector by the year 2015, the company had been aiming to touch the 40% range for online sales. But they were not even able to manage half of this.

- Loss on the Canadian Market

TGT made an aggressive push to enter the Canadian market in the year 2011, but after opening around 133 stores, the company suffered a colossal loss of $2 billion in this market.

- Setbacks

The smaller TGT stores are not functioning so well, and it could cause a disturbance in the overall profits of the company. It is also suffering some significant setbacks in the foreign markets where other competitors such as Walmart and Amazon etc. are performing well.

The Bottom Line:

Well, Target is a big name in the investment industry, and investors have so many hopes with this brand. They are making efforts to reconstruct their retail sector with the changing trends in the eCommerce market. They are also making efforts to catch pace with the online business. Although, their survival in the industry is presently highly dependent on their strategies to retain the competition; it is still maintaining a considerable movement in the market.