Dow Futures Slide Amid Global Stock Going Low on Friday

WASHINGTON, D.C.- Dow Jones futures suggest a much weaker start on Friday after a closed trading day for the Thanksgiving holiday amid the retreating global stocks as concerns escalate over the simmering political dispute over the protester’s human rights in Hong Kong.

Wall Street futures have been flat after a market close for the Thanksgiving holiday in the US but suggest a modest decline for the opening bell on Friday.

On the other hand, the global market is taking most of the burn of the ongoing confusion in the market. Investors are waiting in on the response of the Chinese government after the US signed a bill in support of the pro-democracy protesters in Hong Kong, which has previously sparked a disagreement between Washington and Beijing.

Further, the recent statement from China didn’t help but pushed the stock market even deeper on the lows. The massive decline in global shares on Friday followed the Chinese officials warning that there will be firm countermeasures as a response to the decision of the US President Trump to sign the Hong Kong bill.

According to the statement given by the Foreign Ministry of China, the US legislation will only beef up the firmness of the Chinese people, including the people in Hong Kong, which would raise awareness about the hegemonic nature and the sinister intentions of the US. The foreign ministry’s statement also expressed that the US plot will be doomed.

With the recent news on trade talks saying that the US and China are inching closer to phase one of the trade agreement, the sudden shift in tone from both the biggest economies in the world regarding the signing of the Hong Kong bill has posed a lot of concerns for the market players. Further, investors have also been waiting on the tariff increase on Chinese products with the December 15 deadline.

The negative sentiment in the global market was further dented by the missile test the North Korean military did for the Thanksgiving Day, firing its KN-25 rocket for the fourth time about 230 miles from the Sea of Japan. The recent missile test was suggesting that the year-end deadline on North Korea’s denuclearization talks with the US must have been ignored by the White House.

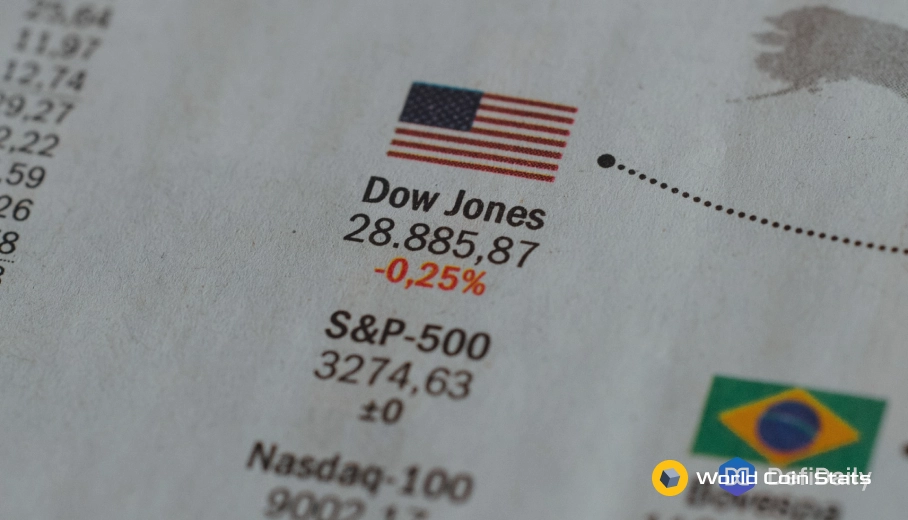

The market holiday in the US also caused light liquidity in the global market, and with the shortened trading week on Wall Street, US equity futures are showing modest declines during the start of trading on Friday. The Dow Jones signals about 78 points pullback while the broader S&P 500 is suggesting an 8.5 points pullback.