Dollar Rises in Japan, Staying Steady in Australia

Tokyo, Japan – The U.S. dollar looks good for the investors in Japan as of Tuesday, as it has advanced against the Yen. This is led by the positivity as a preliminary agreement is being reached between China and the United States. The agreement is regarding the trade war that is currently damaged between the two major countries. The Yen, however, is still fixing the losses they have attained when the investors became comfortable on making risks in the investment.

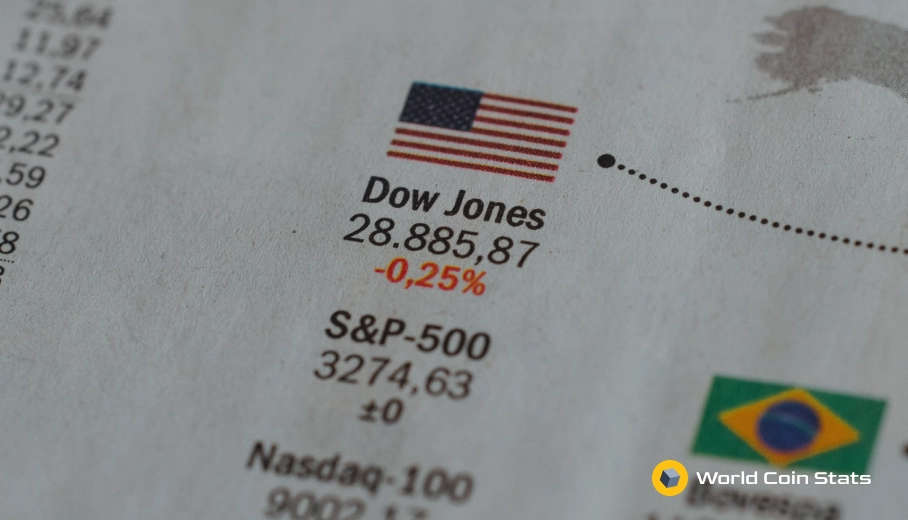

The Yen gained a 0.4% increase on Monday as the dollar increased 0.17% to 108.77 Yen. The Dollar also rose the same rate of 0.17% to 0.9895 Swiss Franc, gaining a 0.2% increase as opposed to Yen’s 0.4% increase.

It has also been reported that China is currently reviewing possible areas in the United States wherein they will be having a trade deal with the U.S. President Donald Trump. This deal is merely for its first phase only. Both countries have also given tariffs on each other on the on-going trade war that has been happening for nearly 16 months now. This has also caused the rise in the threat of an upcoming global recession. Nevertheless, both countries have been giving signs of encouragement regarding the progress on their trade talks.

When progress is to arise on the matter, this would ideally and potentially boost the dollar and will eventually reduce the countries’ needs on easing their money aggressively. However, investors are positive that such trend would continue as time goes on.

Just earlier today, the interest rate on medium-term lending facilities was cut by the People’s Bank of China (PBC) to help in the slowing economy. This is the first time this was done since the last time the interest rate was cut back in 2016.

There is an upcoming non-manufacturing report that will due later today to be submitted by the U.S. ISM that is expected to present the accelerated activities during the month of October of this year.

However, the central bank of Australia maintained its cash rate at a record that is low of 0.75% and repeated their concerns on consumer spending. It has been said that the rates are to remain low for a longer period of time, which states the steady rate for Australia. It is expected that the rates will be cut so that inflation will soon be revived and the slowing economy will be improved.