Define Purchasing Managers Index

Do you want to what PMI stands for? Well, this is actually an excellent indicator for international investors. Moreover, investors use it as a prediction of the country’s growth in which they are going to invest. But what exactly is a Purchasing Managers’ Index? Let’s find out.

Contents

What is the Purchasing Managers’ Index?

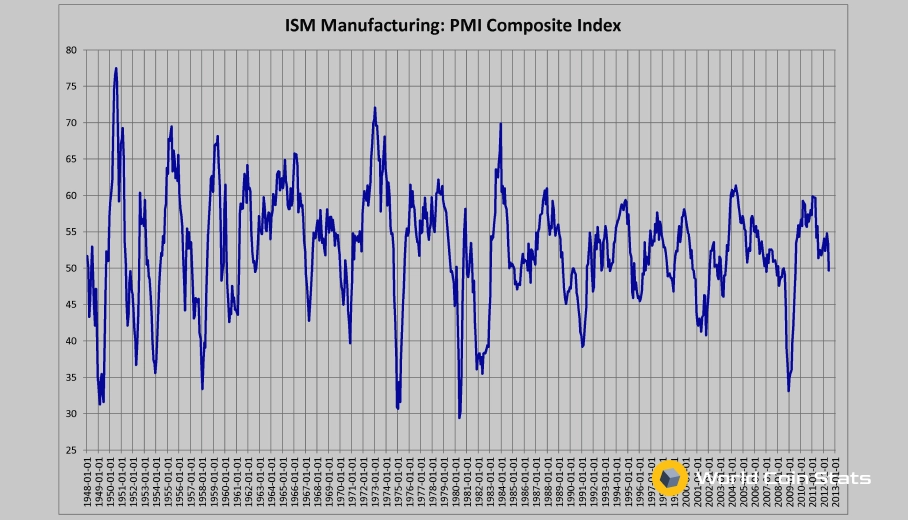

PMI is an economic indicator calculated on the basis of the surveys done on purchasing managers of various businesses in a particular sector. In other words, the Purchasing Managers’ Index is a measure of the prevailing direction of economic trends in manufacturing.

Moreover, this index is based on a monthly survey of supply chain managers across 19 industries. Also, the study covers both upstream and downstream activity. Typically, the service sector and manufacturing sectors are the main sectors on which PMI surveys focus. That’s because, in these sectors, purchases reflect the demand of the consumer indirectly.

How To Calculate The Purchasing Managers’ Index?

To calculate the Purchasing Managers’ Index, the institutes like the IHS Markit Group and the Institute for Supply Management (ISM) conduct surveys monthly. There are many questions and answers in these surveys which are further compiled into numerical data or result. And, this statistical result or index depends upon the solutions to the problems involved in these surveys.

Currently, the PMI is based on a monthly survey sent to senior executives at more than 400 companies in 19 primary industries. Moreover, the index is based on five major survey areas:

- New orders

- Inventory levels

- Production

- Supplier deliveries

- Employment

Also, the studies include questions about business conditions and any changes such as deterioration, improvement, no change, etc. Also, on the other hand, when it comes to the exact process of calculating the PMI, it involves the following steps:

Calculating the Purchasing Managers’ Index

Step 1: First, a weight is assigned to every element involved in the survey.

Step 2: These weights are multiplied by 0, 0.5, or 1.0, depending upon the answer related to each element.

- Improvement – multiplied by 1

- No change – multiplied by 0.5

- Deterioration – multiplied by 0

Step 3: Finally, after calculating the total value, if the reading or value is above 50, it is an indication of improvement. On the other hand, if the value is below 50, this is an indication of deterioration.

Hence, PMI = (Ax0) + (Bx1) + (Cx0.5)

Let’s take a look at the following explanation of what A, B and C represent.

A = Total weight of all the elements/ answers reporting a deterioration

B = Total weight of all the elements/ answers reporting an improvement

C = Total weight of all the elements/ answers reporting no change

Where Is the Purchasing Managers’ Index Published?

There are many places where you can find the data related to PMI. We have mentioned some of these places below:

- Financial news media report the PMI data regularly

- If you are an international investor, you can visit the online platform TragingEconomics to check the data related to the PMI of different countries.

- The Institute for Supply Management (ISM) and the IHS Markit Group. Moreover, these two sources are considered to be the most trusted sources when it comes to collecting the PMI data.

How Can Investors Actually Make Use of the PMI?

As mentioned earlier, the PMI is a good indicator for international investors for predicting the growth of a country. And, it is also a good indicator of change (decline or increase) in the GDP (Gross Domestic Price) of a nation. Hence investors consider it a significant factor when making a decision on which country they should invest in and which they shouldn’t.

Moreover, if the PMI reading of a country is going down, it is good for the investors to avoid or reduce their investment in the equity market of that country. On the other hand, if the PMI reading of a particular country is moving up, the investors should actively start investing in the equity market of that country. In other words, thanks to the help of the Purchasing Managers’ Index, investors can act accordingly to get the most out of their investments.